what is an open end credit account

As you repay the outstanding balance plus any interest you unlock the ability to borrow against the account again. Open-end consumer credit accounts including credit cards and home equity lines of credit accessed by a credit card creditors must mail or deliver periodic statements at least 21 days before the payment is due.

Citibank Bank Statement Psd Template Credit Card Statement Bank Statement Statement Template

The customer then pays the business at a later date.

. If you still decide to close some accounts to help your credit score start by looking at inactive accounts that you no longer use. Open Account An unpaid or unsettled account. An open-end credit plan in which the employee receives a lower rate contingent upon employment that is with the rate to be increased upon termination of employment is not a variable-rate plan.

Open-end credit is an amount of credit that can be borrowed repeatedly as long as consistent payments are made according to the banks terms. A closed account is a loan that is no longer active ie it was paid off. But remember accounts that have been open for a long time and those with high credit limits but low balances may have a positive impact on your credit score.

You can access money until youve borrowed up to the maximum amount also known as your credit limit. Finance charges are based on your changing balance and can change on the banks whim. What is the difference between an open-ended credit account and a revolving account.

A payment term under which the buyer promises to pay the seller within a predetermined number of days and the seller does not restrict the availability of documents that control possession rights to the goods. An open account is an arrangement between a business and a customer where the customer can buy goods and services on a deferred payment basis. A For Credit Card Accounts Under an Open-End Not Home-Secured Consumer Credit Plan Interest will be charged to your account from the purchase date if the purchase balance is not paid in full within theby deferred interest perioddate or if you make a late payment.

An account with a balance that has not been ascertained that is kept open in anticipation of future transactions. Also called a charge account or revolving credit. The open date of a collection account is the date that the account was acquired by the debt collector.

In the case of any credit card account under an open end consumer credit plan under which an over-the-limit fee may be imposed by the creditor for any extension of credit in excess of the amount of credit authorized to be extended under such account no such fee shall be charged unless the consumer has expressly elected to permit the creditor with respect to such. Any agreement to open an account under an open end consumer credit plan under which extensions of credit are secured by a consumers principal dwelling which is entered into after the end of the 5-month period beginning on the date on which the regulations prescribed under subsection a become final. Larger unreported transactions may not be recorded by the end of a reporting period resulting in inaccurate financial results.

Every time the debt changes hands the new collection account will thus have a new open date. This is when a store or company issues a card with. And since its open ended you can borrow and repay the money multiple times as.

An entry into a suspense account may be a debit or a credit. However this practice is illegal as creditors must report accurate information to. Therefore an open-end credit tends to attract a higher interest rate than secured loans from banks and credit unions Credit Union A credit union is a type of financial.

In practice required documentation is sent directly to the buyer or the buyers customs brokerBuyers requesting open account payment terms sums in. Home equity line of credit. Only two types of credit card accounts in consumer credit.

This arrangement is typically capped by the maximum amount of credit that the organization is willing to extend to the customer. Applicable to credit card accounts creditors must give 45-days notice of increases in the Annual. A line of credit is a type of open-end credit.

According to the CFPB a home equity line of credit HELOC is an open-ended credit account that lets you borrow money against the value of your home. Among the categories of information provided are open accounts and closed accounts An open account is an active loan of some sort that you are currently making payments on. The open date does not affect how long the collection remains on your credit report because its the date of first delinquency DOFD that determines when the collection will.

They cannot do that in a normal closed-ended loan. A type of credit extended by a seller to a buyer that permits the buyer to make purchases without a note or security and is based on an evaluation of the buyers credit. The borrower is only billed for the amount that is actually borrowed plus any interest due.

A credit agreement typically a credit card that allows a customer to borrow against a preapproved credit line when purchasing goods and services. A customer sends in a payment for 1000 but does not specify which open invoices it intends to pay. The cost of these types of credit are fees and interest rates charged by the lender.

What is Open Account. In an open-ended contract there is no set pay-off period there is no set payment there is no set interest or finance charge AND you get to re-use that part of your credit limit that youve paid off. Account re-aging generally refers to an old practice when some lenders or collection agencies would change the date when an account first went delinquent to keep it on your credit report longer.

Variable-rate plan rates in effect. Open credit accounts are unsecured credit and no collateral is attached to them. Under a line of credit agreement the consumer takes out a loan that allows payment for expenses using special checks or increasingly a plastic card.

Revolving credit is a type of loan that gives you access to a set amount of money. Example of a Suspense Account.

Fake Credit Card Name Credit Card Online Bank Card Cards

Seven Important Life Lessons Real Credit Card Information Taught Us Real Credit Card Inform Credit Card Deals Visa Card Numbers Credit Card Hacks

Excel Template Credit Card Payoff Get Sales Action Plan Template Xls Excel Xls Templates Paying Off Credit Cards Interest Calculator Spreadsheet Template

Start Building Credit With Self Lender Build Credit Ways To Build Credit Lender

Printable Play Credit Card Kids Credit Card Id Card Template Templates Printable Free

9 Signs It S Time To Seek Debt Help Moneyproblems Ca Debt Help Debt Solutions Personal Finance Blogs

Screenshot This And Review And Pass To Friends No Remember Every Client Profile Is Different Let Me See Good Credit Secure Credit Card Opening A Bank Account

Credit Card Payment Using Vuejs Bar Graphs Interactive Credit Card

The Best Credit Cards For Travel Abroad Pay 0 In Fees Nomad Wallet Best Credit Cards Good Credit Bad Credit Credit Cards

Screenshot This And Review And Pass To Friends No Remember Every Client Profile Is Different Let Me See Good Credit Secure Credit Card Opening A Bank Account

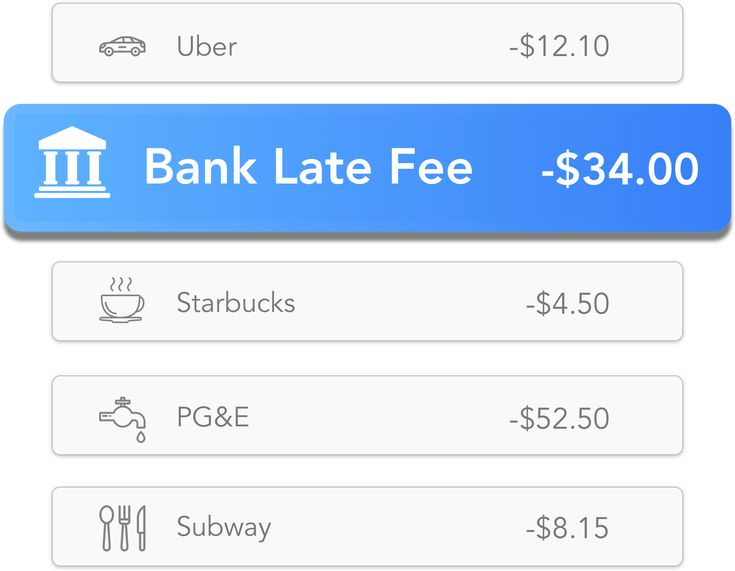

Get Back Hundreds Of Wasted Dollars Cushion Credit Card Fees Bank Credit Cards Credit Repair

Valid Credit Card Number Generator Card Vista Visa Card Numbers Mobile Credit Card Visa Card

Credit Card Debt Payoff Debt Free Instant Printable Chart Etsy In 2021 Credit Card Debt Payoff Credit Cards Debt Debt Payoff

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Loan Account

Why You Shouldn T Swipe Your Credit Card With Chip Secure Credit Card Merchant Services Credit Card Processing

Consumer Loan Application Credit Union Form Http Www Oaktreebiz Com Products Services Consumer Lendi Credit Card Application Consumer Lending Personal Loans

Zeroes Credit Card Grid Credit Card App Credit Card Design Visa Card Numbers

Classroom Economy Editable Dollars And Credit Card Templates Classroom Economy Classroom Economy System Classroom

Have You Heard The News Credit Union Lending Is On The Rise According To The Latest Federal Reserve Repo Home Equity Credit Union Marketing Home Equity Line